Overview

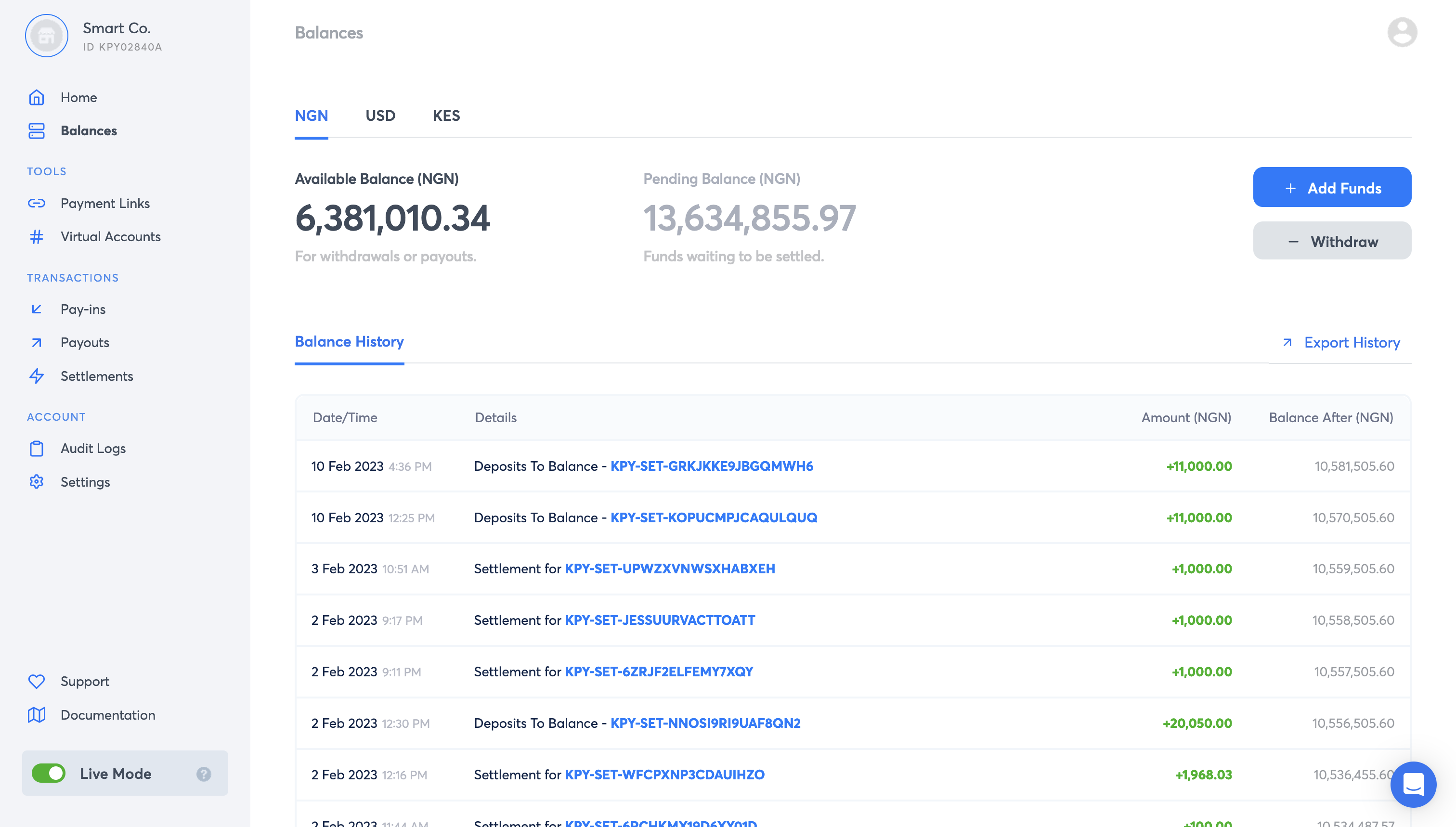

Your Balance on Korapay simply represents how much funds you have in your Korapay account. Funds must first be available in your Balance before you can successfully make payouts, and these funds get into your Balance through Pay-ins - funding instructions (top-ups) and settled payments received from your customers. You can either check your dashboard or use the Balance API to get up-to-the-minute data on available funds and your current positions with Korapay.

Getting balance information can be useful for reconciliatory purposes, preventing failures from insufficient funds, or even fraud detection.

Available and Pending Balances

As the name suggests, your available balance represents funds that are available and ready for you to use - to withdraw or to make payouts. This available balance increases when you top up your balance or receive a settlement for your pay-ins in your balance.

Your pending balance, on the other hand, refers to funds that have been received but are yet to be settled to you. Payments received from your customers are settled to you based on the settlement schedule of your account. Once you’ve been settled, your pending balance is affected as funds become available for use.

Here's an illustration of how your pending balance works. Let’s say your available balance is NGN5,000 and your pending balance is NGN0, for example. If your customer successfully pays NGN2,500 to you, your available balance remains NGN5,000 while your pending balance becomes NGN2,500. Once your settlement schedule is due, funds are moved from your pending balance to your available balance. Your available balance then becomes NGN7,500.

Note that if your settlement destination has been set to your bank account, funds in your pending balance go right into the bank account you set, and not into your available balance.

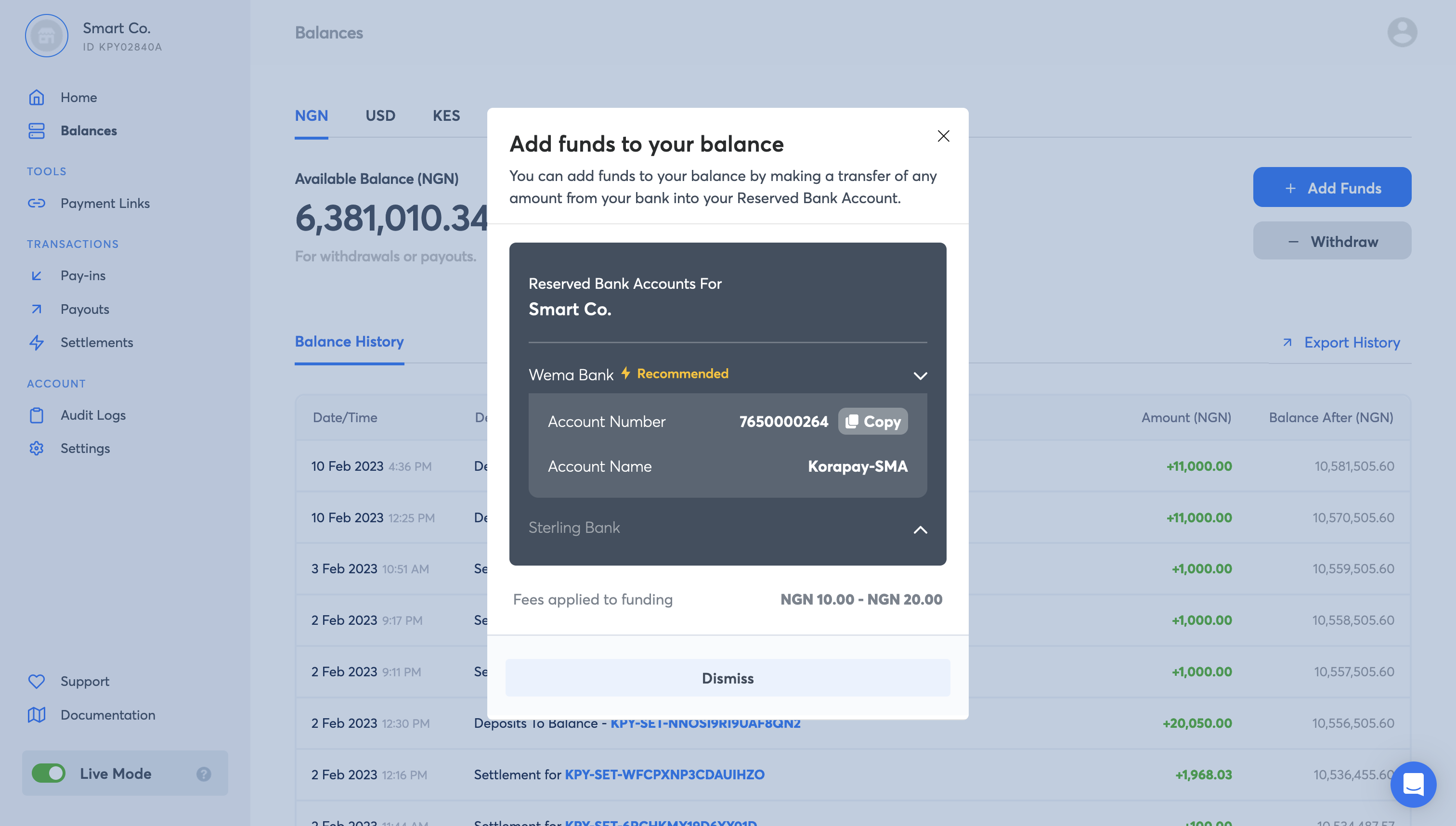

Funding your Balance

To make funds readily available for your payouts, you can conveniently fund your balance right from your dashboard. One way to fund your balance is by making a transfer to your Reserved Bank Account (RBA), a special type of bank account attached to your Korapay account that is exclusively reserved for funding your balance.

To fund your balance:

- Go to the Balances page of your dashboard.

- In the Balance Detail box, click the ‘Add Funds’ button.

- The details of your Reserved Bank Account will be displayed on the funding pop up. Make a bank transfer to the account and your balance will be funded.

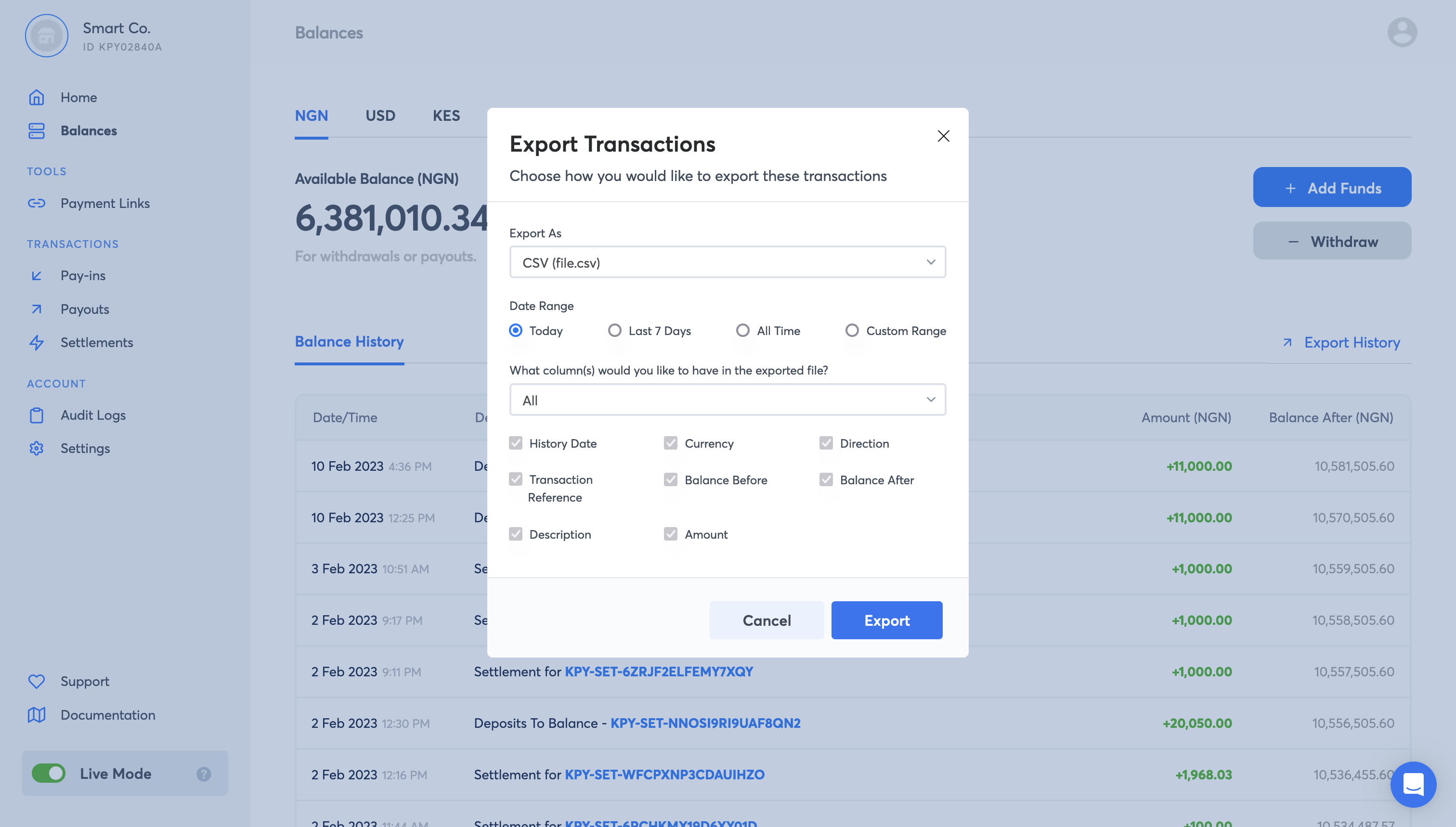

Exporting your Balance History

Your balance history shows the record of debit and credit transactions that make up your available balance. Businesses find this record very useful for reconciliation purposes - you can use it to check if your balances and transactions add up correctly. Korapay also gives you the option to export this record in a preferred format (CSV or Excel) for transactions within any timeframe of your choice. Aside from the amount of the credit or debit transactions, this record also provides information on the balance before and after each transaction.

To export your Balance History, click the ‘Export’ button in the Balance Detail box on your Balances page. Select your preferred export format, choose a date range, and the table columns to be shown in the export.

Note that pending or processing transactions do not affect your balance.

Updated about 1 year ago